It should come as no surprise that having an in-depth understanding of your property’s true value is the first step in obtaining the maximum selling return. Maybe you’ve looked around the neighbourhood and have an idea, but while selling your property, the best approach to gathering useful information is to get an appraisal, in part because it’s possible that the market has changed since you bought the home. Therefore, an evaluation ought to be the initial step. Additionally, it will help you avoid the problem of the house remaining on the market for an excessively long time.

There are several exit plans available when investing in real estate, and you should have chosen one before you ever made the initial purchase. In this article, Mr. Anurag Goel Director at Goel Ganga Developments, covers multiple factors you should consider while selling your property.

Table of Contents

TogglePurchase-and-Hold Investing

Some investors choose “purchase and hold.” They want to buy a house, live there forever, and let the renters pay the mortgage. These investors will eventually collect a portfolio of free and clear properties, and they will be able to sustain themselves from the positive cash flow those properties provide.

The investor will profit from not having to pay any transaction costs associated with selling due to various approaches. Since real estate is less liquid than stocks or bonds, selling requires ending a tenant’s lease, waiting for them to leave, paying for a make-ready to get the property ready for sale, putting the house up for sale, and finalising the deal. In addition to the inconvenience and effort, depending on how quickly the house sells, the sale sometimes necessitates one to three months of vacant property in addition to closing expenses. By purchasing and holding, the investor avoids all of it.

The Right Time To Sell

A sound rule of thumb for market timing is to purchase when it’s a buyer’s market and sell when it’s a seller’s market. Market growth is not steady. Prices grow steadily, but eventually they become expensive for the majority of people, which causes them to plateau and potentially even decline. Investors frequently make the mistake of trying to hold on until the very end in an effort to sell the property at the exact peak of the market in order to make the most money.

Whom to Sell

An investment property typically has three buyers: your renter, another investor, or an owner-occupier who plans to reside there. Both have their advantages and disadvantages. We all are aware of rental scams and there are so many ways to avoid these rental scams. Renting a property is a hectic process for both tenant and owner, Still when it comes to selling a property your renter is the most straightforward option. Your tenant knows the property better than anyone else, so selling to him won’t require you to give him notice, wait for him to leave, and then spend money staging the home for sale. The time and money savings make it an appealing alternative, even if you might not get the best deal this way.

It’s also not too difficult to sell the home to another investor, and having a dependable renter adds to the property’s desirability to prospective buyers.

However, an owner-occupant makes the decision relatively emotionally because they plan to reside there. Discuss your options with your listing agent; they will be familiar with the local market and able to advise on the best course of action.

Find a Reliable Broker

One typical way to find agents is through referrals from friends, family, or other investors, but this does not always mean that the agent is the best choice for the job. As you would with any other service provider, you should carefully consider such suggestions.

The best option for finding an agent is to look for houses like yours on real estate websites. The person one should be looking for is the most active agent in your area and in your asset class. If you’re selling a high-end house in an exclusive neighbourhood, find out which agents have the most listings for expensive homes in the area. For your specific type of house, one will have a buyer group.

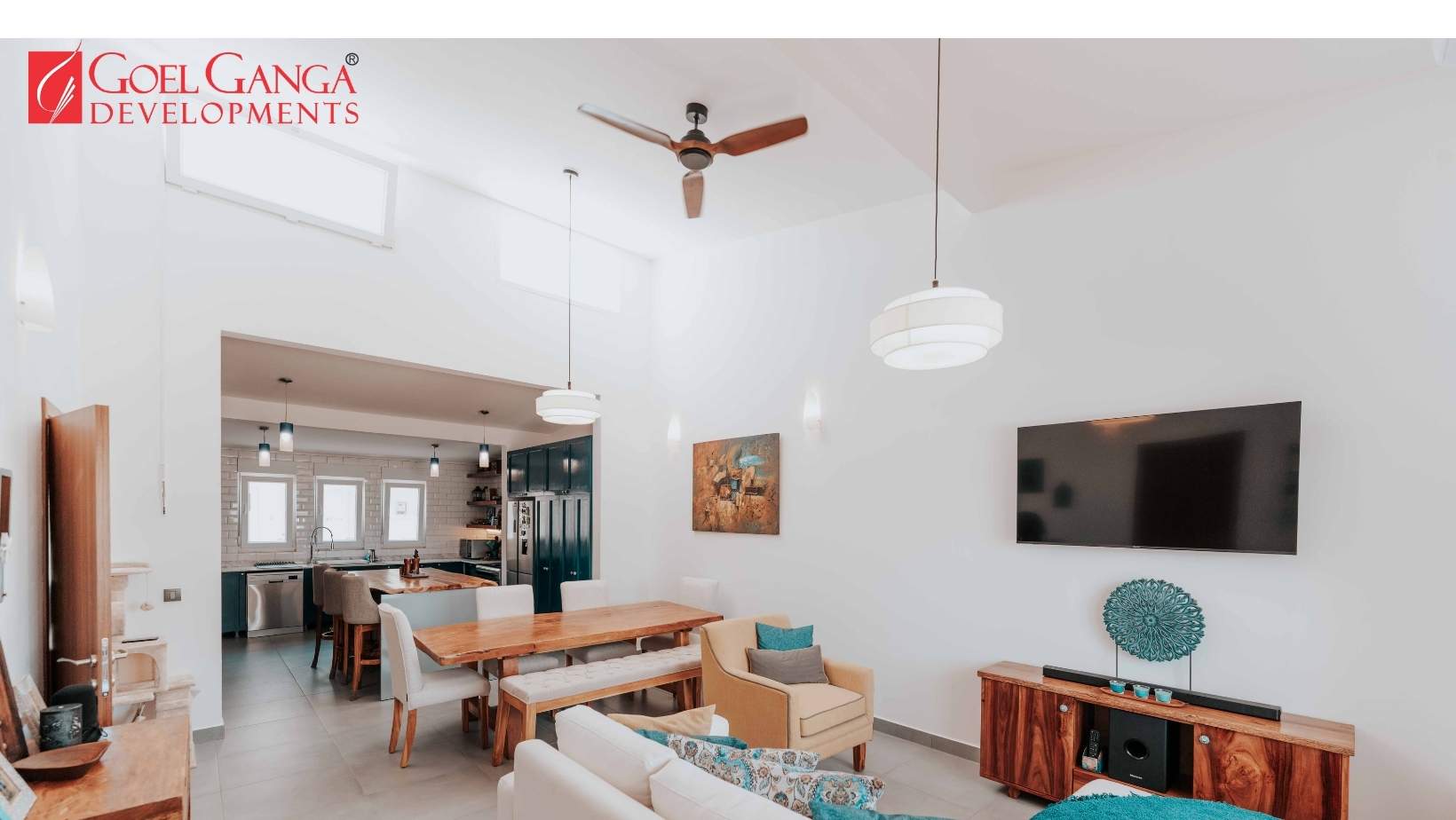

Make Ready

Prior to listing your home for sale, one should clean the carpets, touch up the paint, and perhaps even replace the appliances and fixtures. It’s called “make-ready” under this procedure.

Choosing your spending limit

How much money you should invest in the revamp will depend on who the final buyer is. If you want to sell the property to another investor who will use it as a rental, it might not be wise to include “extras” like granite worktops, gold-plated fixtures, or Siemens equipment in the kitchen. The investor-buyer won’t be able to raise his rentals considerably or even at all because of these extras, which are more expensive.

Managing Contractors

A team of trained experts should be on hand to help make your house ready for the market, both from your property management company and your realtor. Once you find yourself in a situation where you have to find contractors on your own, you’re in trouble.

Competence

Sellers have frequently dealt with landscapers who lacked fundamental abilities and floor tile installers who lacked an understanding of landscaping. Many contractors would say anything to get the quotation and then try to figure it out afterwards. If you are ready and prepared, even if that method may have worked for them in the past, it won’t work for you. You don’t want to be the experiment if a guy is learning on the job!

Reliability

Some contractors may take your money but not complete the job or even phone you in order to let you know that they aren’t going to be there. They actually got another employment opportunity over the weekend, so he went to that location first, as it turned out. When he has time, he will visit your property. This happens often.

Fraud

Fraud is yet another important problem with contractors. The contractor decides to utilise some leftover countertops from a previous job in place of the lovely granite countertops and backsplashes that your interior designer may have selected, even though the patterns clash with the backsplashes and the colour isn’t what you expected. He thought he could just utilise the old counters and retain the money someone had provided him for counters, and no one would notice since he had no sense of beauty.

It takes a lot of effort to market a property at the right time and for the right price. Before selling your house, it is a good idea to be informed about the state of the local real estate market. Over the previous year, has the pricing trend changed? The state of the market may be used to negotiate pricing for what you want.

Be aware of how supply and demand for real estate are faring in the vicinity. What is the profile of the buyer? If a buyer has several alternatives in the vicinity, it’s best to keep the price reasonable because extra negotiation is tricky.

2 thoughts on “Maximizing Returns: Timing and Techniques for Selling Your Property”

Pingback: Is Ganesh Chaturthi good for Griha Pravesh?

Pingback: The Biggest Factors That Can Help Sell an Investment Property - Miha Matlievski - Fail Coach