It is the dream of every person to own a home. A place to call ours is a fantasy that every human being has. Today, unlike olden times, a person doesn’t need to wait for years in order to amass the wealth to buy a house. Home loans have turned the dream of buying a home into a reality. There are so many various schemes and plans, availing which any person can realize his dream of buying a home of choice. As to the ways to get a home loan approved, well, here are some simple ways to do so.

Table of Contents

ToggleSufficient savings

Sufficient savings would go a long way in helping you get that home loan approved. While you may resort to taking a loan from a money lender or a bank, still it is imperative that you have sufficient saved money to make the down payment of your home. With savings under your belt, it would

be easier for you not only to get a home loan approved, but it would also relieve you of the tension of paying it back, as eventualities can happen at any time. So, savings can take away the stress of paying back the loans.

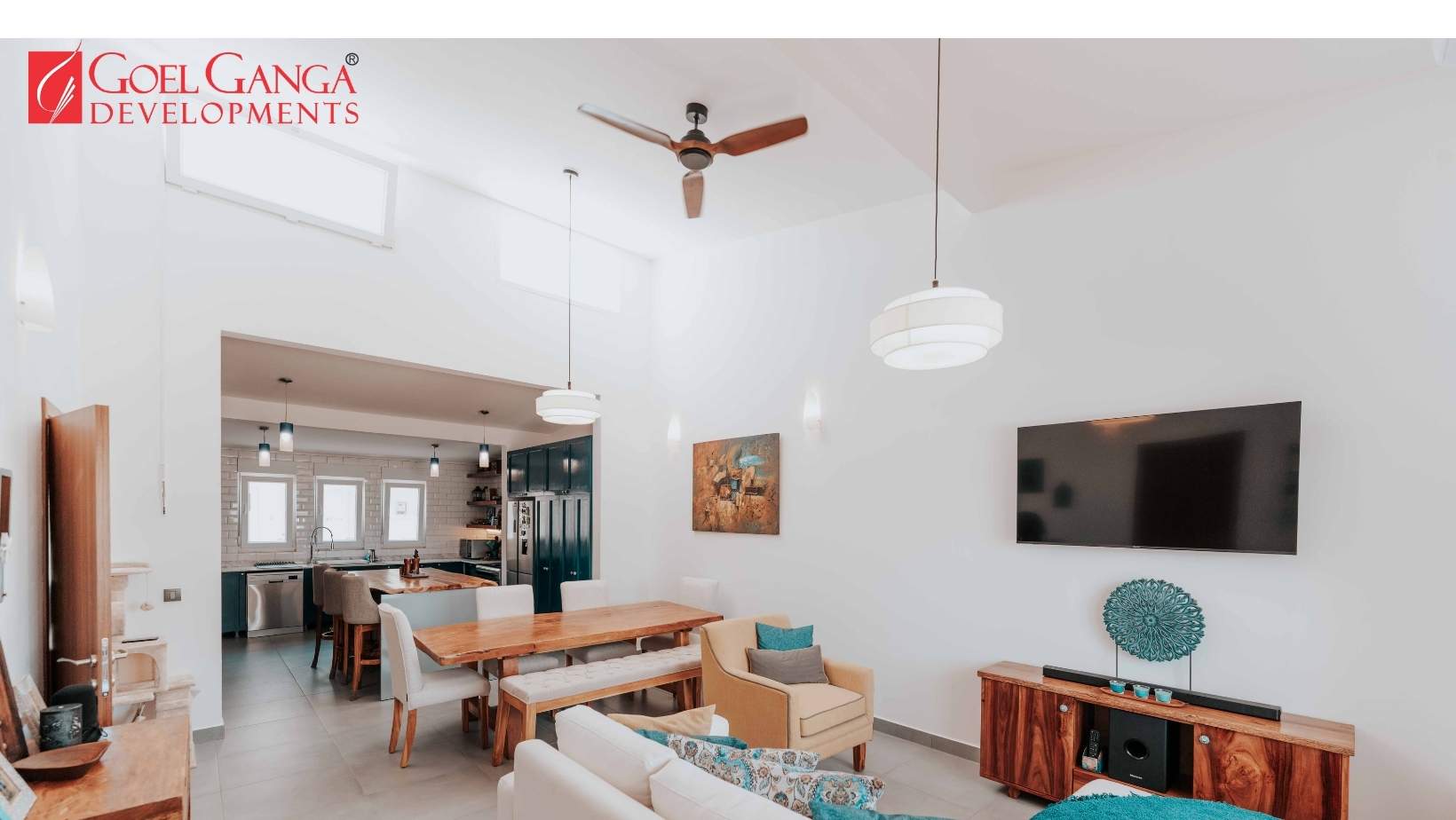

Property Type

Reputed builders often tie-up with banks to make availing of home loans an easy task for their customers. Furthermore, the availability of the loans would also depend on other factors, like the type of building chosen to buy the property into, the reputation of the builder of the said property, and the legal status of the chosen building. Going for legally clean properties would aid you much in availing the loan, as no one wants to be surrounded by the chaos caused by a disputed property, so

getting a loan for a property that is under dispute would prove to be a daunting task.

Consistent Employment

No person in their right frame of mind should even think of buying a property if their source of income is not consistent or stable. It is by far the most important factor to consider before planning to buy a house. Being consistently in a stable form of employment and having a good record as far as your commercials and economic stability is concerned, would pave the way for obtaining that home loan easily and fluidly.

Consistency in the form of the place of employment or the salary is also important. Stable employment in the same firm for a duration of at least two years or something to this effect in another similar organization along with a consistent salary has to be ensured. Even if a change of job is on the cards around the time that you wish to apply for a home loan, you can plan it in such a way that it does not interfere in the process of your procuring the loan.

Clearing your debts

If you are a person who believes in the system of taking loans in order to buy various expensive stuff and yet are capable of clearing them in a regular and consistent manner; then it will create a positive effect of your personality on the concerned money lender or bank. Your reputation as an honest and responsible person would enable and increase your chances of getting the home loan approved. Furthermore, another important factor that would be beneficial in deciding whether or not your home loan is approved is the ratio of your income in relation to your debt. Here, maintaining the capacity to manage and balance all the loans that you have taken thus far would be a dominant factor that would decide whether or not your loan gets approved or not. A person is more likely to receive a loan if he has a low debt to income ratio.

By taking these factors into account, your path towards the procurement of the loan would become easy and smooth. It is to be kept in mind that whether it is banks or money lenders, no one wants disruption or chaos in the form of unpaid dues or loans. An individual who is capable of

paying back the loans on time would always be favorable to all.

Hence, it is imperative that a person keeps in mind his financial status and capacity while applying for any type of home loan. This would make the process so much simpler, and wouldn’t prove to be a burden mentally, emotionally, or financially.