Buying a new home is both exciting and emotional. For many Indians, it is a dream come true. But another aspect of buying a home is that it is really expensive. A housing buying process can turn itself into a great asset or worst liability, depending on how you approach your financial planning.

So whenever you plan to buy a house, make sure you got your basics right. Having the basic knowledge of real estate and the documentation process will really help you make decisions that are best for your family and light on your pocket.

These are the 11 critical steps you should understand before buying a house

1. Understanding Why You Want To Buy A House

Purchasing a new house is a major turning point in everyone’s life and shouldn’t be treated lightly. It is important to define your financial and personal goals before proceeding your plans to buy a home.

Are you looking at your house as a security option or as an investment opportunity? Financially, you should be able to afford and maintain the house.

You need to ask yourself, whether this roof is temporary, if yes when are you moving out? Also, you need to decide the kind of amenities you need in your house, your ideal location and how long will it take for you to save your first down payment.

Not being aware of all these decisions could harm you in the long run. Identifying your goals and aligning it with your budget is the first and the critical step of the home buying process.

2. Checking Your Credit Score

If you are contemplating financing options for your home, you must have come across the terms good credit score and bad credit score, Almost all the banks in India today, lends the loan only if you exhibit a good credit score.

For banks and other financial institutions, to believe your ability to pay back the loan, they check your financial stability and discipline in handling the money.

This is definitely true when it comes to home loans since the amount lent in this process is quite huge.

A credit score is a three-digit number, which grades the credit history of an individual. It is based on numerous factors including, borrower’s payment history, credit enquiries, loan repayment, your annual expenditure etc.

The credit score between 650 to 850 is considered to be a good score, however, some financial lenders also lend the amount with 550 as the credit score. Anything less than 550 is considered as indiscipline and prevents you from numerous financial schemes.

3. Planning A House Buying Budget

Here is the most critical part – Determining the budget for your house. Many people confuse the budget with the actual amount you need to buy a house, but there are other expenses.

The buyers always forgot to ask the processing fee and more importantly the maintenance cost. Lenders don’t take into account your monthly maintenance cost while lending you a loan. You need to keep some extra amount in your savings for last-minute emergencies.

It is recommended that you first plan your house buying budget, gain approval from your financial lender and then visit your realtor. Since there is no point in hunting down homes which you cannot afford.

4. Saving The Down Payment

After setting a home budget, you need to save for your down payment, if you haven’t already started. It may take several months or years to save even the fraction amount of your down payment.

Being willing to pay less down payment will ensure a faster loan approval process but putting more, lower down your overall cost and rate of interest.

Research the down payment requirements of different financial institutions and select the one suitable for you. Calculate how paying different amounts of a down payment could affect you in both long and short term.

5. Hire A Reputed Real Estate Agent

Hiring a reputed real estate agent will save you a lot of headaches and probably money and time. A real estate agent is the key to finding your dream home and negotiate on your behalf to crack the best deal.

A real estate agent should be on your side and recommend you to other professionals like lawyers, developers, contractors and help you compare fees for different services.

Real estate attracts a lot of paperwork, an agent could help you navigate through all the documents necessary for a smooth deal.

Before you hire a real estate agent please track down their history and study their portfolio. Study how they have performed in areas you wish to buy a home.

Someone with the knowledge of an area tells whether the budget is realistic or not. They can also point to some interesting neighborhood to buy affordable homes.

6. Checking Multiple Options

Once you decide a real estate agent, they may list your name into local real estate listing websites which recommend you choices based on your criteria. You should let your real estate agent know your requirements and the specific location or look for properties online.

It is recommended to drive through the neighborhood you wish to buy and see for what’s for sale.

You may not be able to check everything off your home amenity requirements, so make sure you list the items which you can’t afford to second guess.

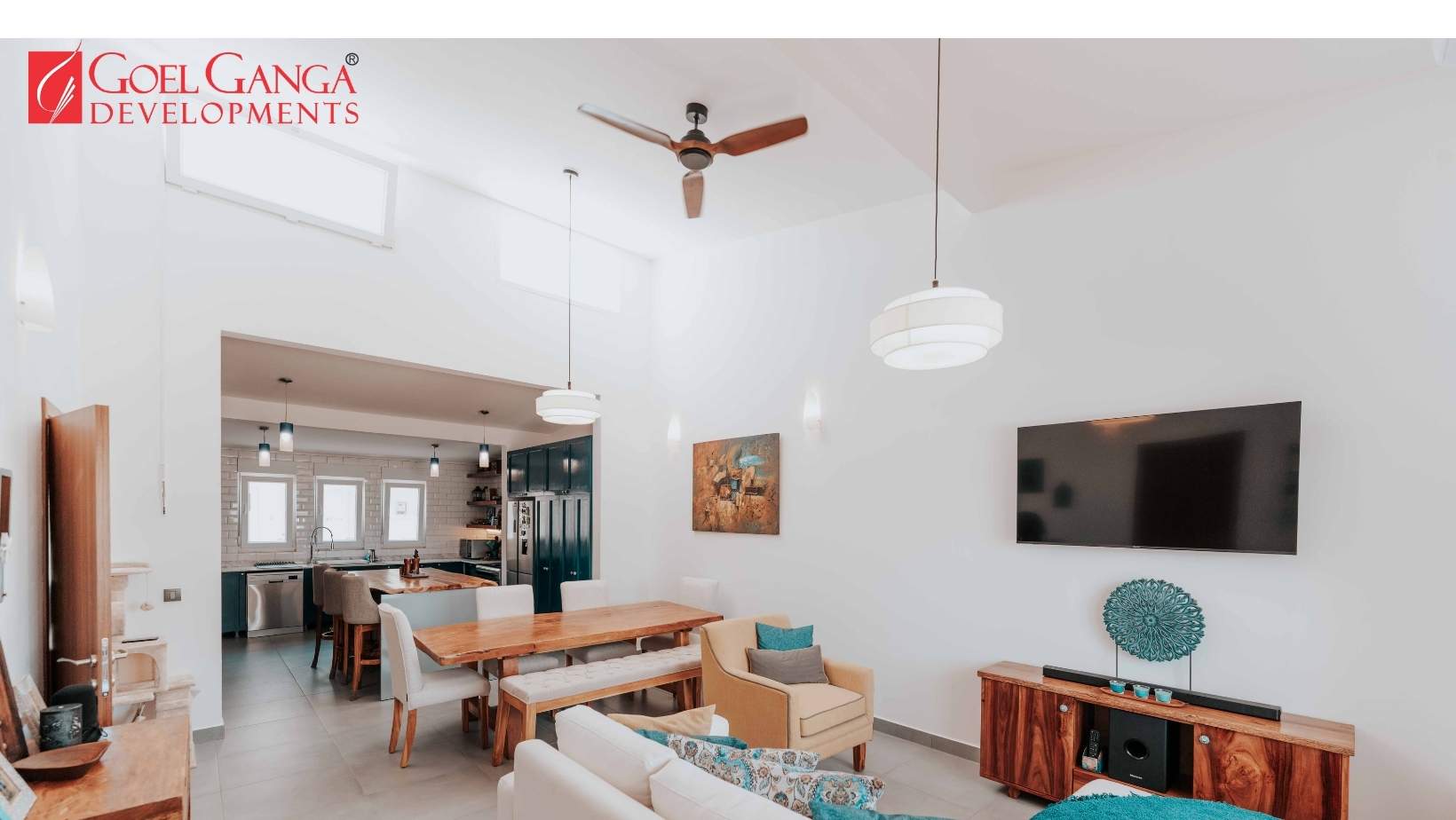

Photos listed online could be misleading and hence it is recommended to check the apartments personally to make an informed decision.

7. Making an Offer

Once you finalize the house, it is time to make an offer. A complete offer package includes your offer, loan approval documents, proof of funds for down payment and a personal letter to request your seller to sell you the house (This makes your offer standout of the crowd)

Seller may counteroffer on your demands, offer price or other contingencies. See whether you can negotiate the terms or else move on.

Once you accept the offer, you’ll need to sign a purchase agreement and offer 1-2% of the money in cash, which shows you are serious about making the purchase. The seller may have a right to keep the amount if you cancel the deal abruptly.

Although, there are some cases where you can back off without paying any penalties. The home inspection clauses and procedure is designed to protect these consumer rights. If the home inspection report shows major problems, you can back off from the agreement and take your earnest money back.

8. Doing an Inspection

A home inspection helps you get an overall picture of the mechanical and structural integrity of the building. There are numerous laws and permissions you need to follow before starting the construction.

Ask your real estate developer all the approved plans and permits for the construction of the building. Failing to get any approvals may render the whole project as illegal.

You have the right to choose your own home inspector. You may take the help of your real estate advisor or choose your own. Make sure the inspector you hire is an experienced professional. Look for online reviews or ask your friend for recommendations.

The home inspection will help you figure out how to close the deal. You might ask your seller for repairs, back off from the deal or make arrangements for future repairs after moving on.

9. Securing Your Financial Options

At this point, you need to submit additional documents while your seller closes their side of the deal. Documents might include tax receipts, parent deed, sale deed, income proof, loan proof or any additional documents regarding the deposits made.

Avoid taking any decision which may harm your credit score. Don’t take any major loan, run up credit cards or change your job. All these things can influence your credit score and pose problems for any financial credit.

Respond promptly to any document verification and be ready with all the originals. A preapproval doesn’t mean that your loan is approved until the final stamp is marked.

10. Final Go Through

The final go through is the last time you review all the things which you find necessary before the house become yours. Keep your real estate agent with you before making any last-minute decisions and ask any questions you may have.

Come with all the necessary checklist and review the repair, modification conducted, ensuring everything is as promised in the purchasing agreement.

This is your last chance to view the property as a third party member before it becomes your responsibility.

11. Closing The Deal

Once all the requirements and contingencies are met, you are happy with all the repairs and modification and the seller has given green light to close, you can sign the final sales agreement. Your financial advisor will issue a No Objection Certificate (NOC) for the status of your loan.

Your sales agreement outlines all the basic details of the entire deal. Like the down payment amount, the loan amount, the terms and condition, your personal details, monthly installment and how much money you should pay before closing the deal.

At the closing, you (buyer) will attend, the owner of the property and if necessary the real estate agent you hire to make the process smooth.

Once all the paperwork has been signed, the house is officially yours. Review all the documents carefully and correct any errors like name, amount or any other personal details.

Wrapping Up

Buying a house involves a lot of complex procedures and paperwork. We are sure this guide will definitely help you with your basics. This guide combined with a professional expertise could help you crack down the best deal possible. At any stage of the buying process, don’t hesitate to ask questions, no matter how unrealistic it may sound. Buying a house is a one time opportunity for most people and we want to make sure you do it right. Doing your research will give you confidence and knowledge for effective decision making.

1 thought on “Home Buying Guide – How To Buy A Home in India in 2019?”

Pingback: Separating Fact From Fiction: 5 Home Buying Myths - Goel Ganga Developments