Buying a home is more than just buying walls and windows. It is a turning point in life. It is a moment of trust, belief and stability. For most Indians, owning a home is an emotional milestone and not just a financial decision.

But here is the truth that many buyers realize later…

Simply paying money for a home does not make you the legal owner.

You become the legal owner ONLY when that property is registered in your name.

That is why property registration is one of the most important legal steps in real estate. It gives your ownership legal recognition. It protects your investment. And it ensures that no one can challenge your rights in the future.

Table of Contents

ToggleWhat Is Property Registration?

Property registration is the legal process of recording the ownership details of a property with the Government of India. It updates the government records with the name of the buyer. Once registered, the sale becomes legally valid.

The law that governs this process is the Registration Act, 1908.

Registration makes your ownership transparent, traceable and protected by law.

Why Is Property Registration Important?

Registering a property:

- Gives you legal ownership rights

- Prevents disputes

- Protects you from fraud

- Helps you use the property for housing loans

- Makes future resale easier

- Creates a permanent Government record that the property belongs to you

This is why the registration of property is more than a routine step. It is a legal shield that protects your rights as a buyer.

In simple words → No registration = No legal ownership.

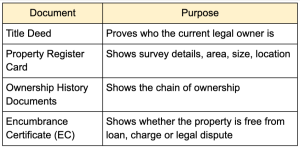

Documents Required For Property Registration

Registration needs paperwork.

Documents prove who owns the property, whether there are legal issues, and whether the buyer and seller are genuine.

Here are the main property registration documents:

1) Ownership-related documents

- Title Deed – Proves who the current legal owner is

- Property Register Card – Shows survey details, area, size, location

- Ownership History Documents – Shows the chain of ownership

- Encumbrance Certificate (EC) – Shows whether the property is free from loan, charge or legal dispute

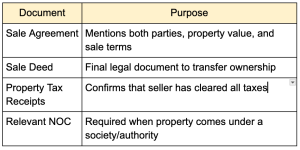

2) Transfer-related documents

- Sale Agreement – Mentions both parties, property value, and sale terms

- Sale Deed – Final legal document to transfer ownership

- Property Tax Receipts – Confirms that seller has cleared all taxes

- Relevant NOC – Required when property comes under a society/authority

3) Identity & Payment Proofs

- Aadhaar / PAN / Passport / Driving Licence

- Address proof

- Stamp duty payment receipt

- Registration fee payment receipt

These documents are verified at the Sub-Registrar Office.

Step-by-Step: How To Register a Property in India

Here is how registration actually works:

Step 1: Collect All Documents

Verify the title, EC, sale agreement, ID proofs, etc.

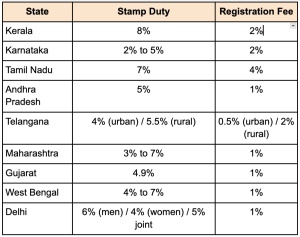

Step 2: Calculate Stamp Duty & Registration Fee

Each state has different rates.

These charges are paid by the buyer.

Step 3: Pay Fees (Online or Offline)

Most states now allow online payment.

Step 4: Visit Sub-Registrar Office

Buyer + seller + 2 witnesses must be present.

Step 5: Biometric Verification

Fingerprint + photograph of buyer, seller, witnesses.

Step 6: Submission & Approval

The registrar checks the documents.

Step 7: Collect Registered Sale Deed

Usually within 2–7 days.

Only after this step, you officially become the legal owner.

How To Check Property Registration Online

Most states today offer online property record search.

General steps:

- Visit state’s land records portal

- Go to “Search Property / EC / Ownership Details”

- Enter required details (survey number / document number / year)

- Complete captcha

- Download ownership details or EC

This is helpful to confirm whether the property reflects in your name.

Property Registration Charges Across India

Registration charges include:

These are calculated based on a percentage of the property value.

TDS & Tax Rules in Property Registration

- If property value ≥ ₹50 lakh → Buyer must deduct 1% TDS

- This must be deposited to Government before final payment

Power of Attorney (POA) in Property Registration

If a buyer/seller cannot attend physically → they can appoint someone with a Power of Attorney.

POA must be:

- clear

- signed

- stamped

- registered

What Happens If You Don’t Register Property?

If you do not register the property:

- ownership is NOT valid

- property legally still belongs to the previous owner

- disputes become more likely

- you cannot claim rights in court

Cancellation of Property Registration

Registration cannot be cancelled casually.

It requires a Court Order and a Cancellation Deed.

Why Choose Goel Ganga Developments?

Because real estate is not just about land and concrete.

It is about trust.

Goel Ganga Developments has built that trust for decades.

We guide buyers through every legal formality — including:

- document checklists

- clarity on stamp duty and registration fees

- guidance on Sub-Registrar Office process

- support with timelines and appointments

Many homebuyers feel property registration is stressful.

With the right realtor, it becomes simple and smooth.

Goel Ganga Developments ensures transparency, clarity and support at every stage.

Your dream home should come with peace of mind. And that peace begins with proper registration.

Your home is not just a place.It is a legacy. And registration protects that legacy.

FAQs

1) Is property registration compulsory?

Yes. Without registration, the buyer does not become the legal owner.

2) Who pays stamp duty?

Usually the buyer.

3) Can registration be done fully online?

No. Final signature & biometric verification must be done at the Sub-Registrar Office.

4) How long does registration take?

Usually the final deed is available in 2 to 7 days.